Bitcoin ETF trends 2024 are shaping up to be a wild ride. If you’ve been following the latest news, you’d know that Spot Bitcoin ETFs have just clocked in seven consecutive days of outflows. This isn’t just another blip on the crypto radar—it’s a significant event that has every market watcher on the edge of their seat.

The big question now is, what does this mean for the rest of the year? Are we looking at a temporary dip or the start of something bigger? Let’s dig into the data and see what the past can teach us about the future of Bitcoin ETFs. Grab your favorite beverage, sit back, and let’s dive into this rollercoaster of a market trend together.

Understanding the Recent Bitcoin ETF Trends 2024

Bitcoin ETF trends 2024 have grabbed headlines as Spot Bitcoin ETFs faced seven consecutive days of outflows. This alarming pattern has raised questions among investors. Understanding these trends helps us navigate the unpredictable crypto waters. Let’s delve into the key aspects of these trends.

A Brief History of Bitcoin ETFs

Bitcoin ETFs have come a long way since their inception. Initially, the idea of a Bitcoin ETF excited many investors. It promised easier access to Bitcoin investments without directly buying the cryptocurrency. Over the years, Bitcoin ETFs gained traction and became a significant part of the market. Besides, they offered institutional investors a regulated way to participate in the crypto market. However, they also brought challenges, such as dealing with market volatility and regulatory scrutiny.

Key Events Leading Up to the Outflows

Several key events have led to the recent outflows. First, a decline in Bitcoin’s price sparked concerns. Institutional investors started selling off their holdings, leading to further price drops. Additionally, miners began selling their Bitcoin to cover operational costs. This created a domino effect, causing more outflows. Furthermore, the overall market sentiment turned bearish, amplifying the sell-offs. These events collectively contributed to the seven-day outflow streak in Spot Bitcoin ETFs.

Comparison with Past Trends

Comparing the current trend with past events reveals interesting insights. Back in April-May 2024, Spot Bitcoin ETFs experienced a similar pattern. They bled for seven consecutive days, but the outflows were even higher. On May 1, 2024, the largest single-day outflow recorded was $563.7 million. This past trend shows that the market has faced similar challenges before. However, it also suggests that recovery is possible. In May 2024, the funds saw 19 consecutive days of inflows after the outflow period. This comparison offers hope for a potential turnaround in Bitcoin ETF trends 2024.

The Impact of Institutional and Miner Sell-Offs

The recent outflows in Spot Bitcoin ETFs have raised concerns. Understanding the roles of institutional investors and miners helps explain the current market dynamics. Let’s explore how their actions influence Bitcoin ETF trends 2024.

How Institutional Investors Influence the Market

Institutional investors wield significant power in the crypto market. When they buy Bitcoin, they drive up demand and prices. Conversely, when they sell, prices often drop. Recently, institutional sell-offs have coincided with the outflows in Spot Bitcoin ETFs. This indicates that their actions directly impact the market trends. Moreover, their decisions often influence other investors, creating a ripple effect. Lastly, institutional investors’ behavior can signal broader market sentiments, making their actions crucial to understanding Bitcoin ETF trends 2024.

The Role of Miners in Bitcoin Price Fluctuations

Miners play a pivotal role in the Bitcoin ecosystem. They secure the network and validate transactions. However, they also need to cover their operational costs, which often means selling their mined Bitcoin. When miners sell in large volumes, it can drive down prices. Recently, miner sell-offs have contributed to the outflows in Spot Bitcoin ETFs. This adds another layer of complexity to the market dynamics. Besides, miners’ actions can create short-term price fluctuations, impacting investor sentiment.

Correlation Between Sell-Offs and ETF Outflows

The correlation between sell-offs and ETF outflows is evident. Institutional investors and miners selling their holdings have led to significant outflows in Spot Bitcoin ETFs. This pattern shows how interconnected the market is. Furthermore, it highlights the importance of understanding the roles of different market participants. By analyzing these correlations, investors can gain better insights into Bitcoin ETF trends 2024. Moreover, recognizing these patterns helps predict potential market movements.

Analyzing the Data: What Do the Numbers Say?

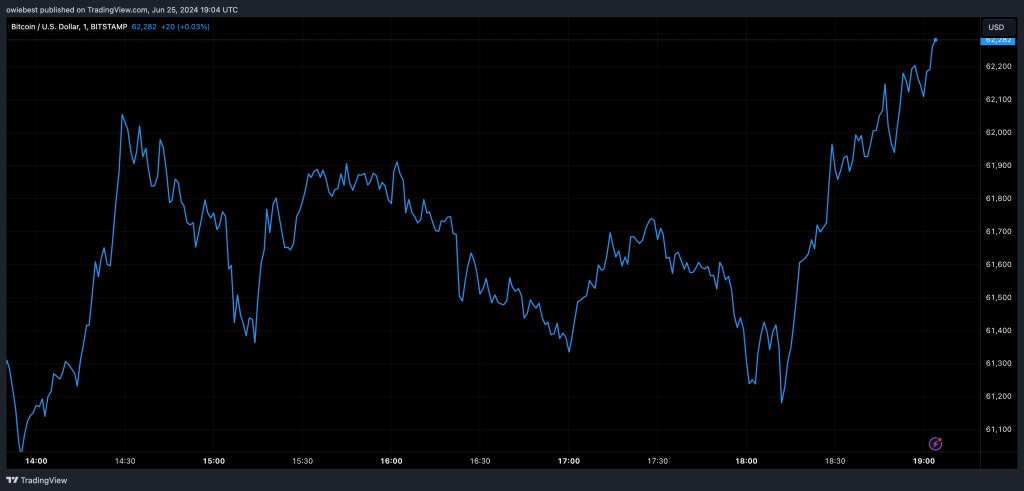

Analyzing the data behind the recent outflows provides a clearer picture. Let’s look at the daily averages, significant single-day outflows, and historical data to understand the current Bitcoin ETF trends 2024.

Daily Outflow Averages and Totals

According to data from Coinglass, Spot Bitcoin ETFs have marked their 7th consecutive day of outflows. The outflows have averaged around $100 million daily. This amounts to approximately $1.2 billion pulled out from the funds so far. These numbers indicate a significant market shift. Besides, they show the scale of the recent sell-offs. Understanding these daily averages helps grasp the magnitude of the current trend.

Significant Single-Day Outflows

Significant single-day outflows have further impacted the market. For instance, back in May 2024, the funds lost $563.7 million in a single day. Such large outflows create immediate market reactions. They often lead to price drops and increased volatility. Moreover, they highlight the influence of major sell-offs on Bitcoin ETF trends 2024. Recognizing these critical moments helps understand the overall market dynamics.

Historical Data and Predictions

Historical data offers valuable insights into future trends. The past outflows in April-May 2024 eventually led to a recovery. Starting from May 13, 2024, the funds recorded 19 consecutive days of inflows. This historical pattern suggests that the current outflows might not last indefinitely. Besides, it indicates potential for a market turnaround. By analyzing these historical trends, investors can make more informed predictions about Bitcoin ETF trends 2024.

Potential Turnaround: What History Tells Us

The current outflows might seem alarming, but history offers hope. Let’s explore previous outflow and inflow patterns, market recovery indicators, and predictions for the rest of 2024.

Previous Outflow and Inflow Patterns

Looking at previous patterns, we see a cycle of outflows followed by inflows. In April-May 2024, the funds bled for seven consecutive days. However, after this period, inflows surged for 19 days straight. This pattern shows that the market can recover from significant outflows. Moreover, it highlights the cyclical nature of Bitcoin ETF trends 2024. Understanding these patterns helps predict potential future movements.

Indicators of Market Recovery

Several indicators suggest a potential market recovery. First, Bitcoin’s price is still trading above its 200-day moving average of $50,613. This indicates long-term bullish sentiment. Additionally, daily trading volumes are up, showing increased market activity. These factors suggest that the current outflows might be a temporary dip. Besides, historical patterns indicate a possible turnaround. Recognizing these indicators helps investors stay optimistic about Bitcoin ETF trends 2024.

Predictions for the Rest of 2024

Based on historical data and current indicators, we can make some predictions. If the past trends repeat, we might see a surge in inflows soon. This could drive Bitcoin prices higher and stabilize the market. Furthermore, as institutional investors regain confidence, their participation could fuel further inflows. Lastly, the overall market sentiment might shift towards a more positive outlook. These predictions offer a glimpse into the potential future of Bitcoin ETF trends 2024.

Long-Term vs. Short-Term Bitcoin Performance

Bitcoin’s performance varies over different timeframes. Understanding the long-term and short-term metrics helps investors navigate the market effectively. Let’s analyze these aspects in the context of Bitcoin ETF trends 2024.

Bitcoin’s Long-Term Bullish Indicators

Bitcoin’s long-term indicators remain bullish. Despite recent outflows, the price stays above its 200-day moving average. This suggests sustained investor confidence. Moreover, the growing adoption of Bitcoin by institutions and retail investors supports a positive long-term outlook. Besides, historical trends show that Bitcoin often recovers from significant dips. Recognizing these bullish indicators helps maintain a long-term investment perspective.

Short-Term Performance Metrics

Short-term metrics paint a different picture. Bitcoin’s price has fallen below its 50-day and 100-day moving averages. This indicates the short-term bearish sentiment. Furthermore, recent outflows in Spot Bitcoin ETFs add to the uncertainty. However, daily trading volumes have increased, suggesting a potential recovery. Understanding these short-term metrics helps investors make timely decisions in response to Bitcoin ETF trends 2024.

Strategies for Investors in 2024

Investors need effective strategies to navigate the current market. First, focus on long-term bullish indicators for sustained growth. Second, monitor short-term metrics to identify buying opportunities. Additionally, diversify investments to mitigate risks associated with Bitcoin volatility. Lastly, stay informed about market trends and news. These strategies help investors capitalize on Bitcoin ETF trends 2024 and maximize their returns.

Conclusion

Bitcoin ETF trends 2024 are more than just numbers on a chart—they’re a window into the future of cryptocurrency investment. By understanding the patterns and influences behind these trends, investors can make more informed decisions and navigate the ever-changing crypto landscape with confidence. Keep your eyes on the data, stay informed, and remember that in the world of Bitcoin, the only constant is change.