In the fast-evolving realm of digital finance, 2024 has unfurled a troubling narrative: Crypto cybercrime 2024 is making headlines with a staggering $1.38 billion pilfered from investors in the first half of the year alone. This surge in hacks and thefts marks a doubling from the previous year, underscoring the relentless ingenuity of cybercriminals in targeting the burgeoning cryptocurrency sector. From major exchange breaches to sophisticated phishing schemes, the landscape of crypto security is increasingly fraught with challenges, demanding vigilant protection of digital assets and robust regulatory responses.

Understanding Crypto Cybercrime 2024

As we dive into the tumultuous waters of Crypto Cybercrime 2024, the scope and impact are strikingly clear. With a staggering $1.38 billion siphoned from investors in just the first half of the year. Beyond mere numbers, these incidents highlight the persistent ingenuity of cybercriminals in targeting vulnerabilities within the cryptocurrency ecosystem.

The Rising Tide: Scope and Impact of Cybercrime

Besides the eye-watering sums involved, Crypto Cybercrime 2024 has reverberated across the financial landscape, leaving investors grappling with unprecedented losses and uncertainty. Major breaches, such as the DMM Bitcoin hack in May, where over 4,500 BTC worth more than $300 million at the time were plundered, underscore the vulnerability of centralized exchanges. Furthermore, the median hack size has surged by 150%, amplifying concerns about the resilience of crypto infrastructure against determined attackers. Moreover, these incidents not only jeopardize individual investments but also cast a shadow on broader market confidence.

Major Incidents: Case Studies and Lessons Learned

Examining major incidents like the DMM Bitcoin hack reveals crucial lessons for investors and the industry at large. Besides the direct financial impact, such breaches illuminate the critical importance of robust cybersecurity measures and proactive risk management strategies. Moreover, they emphasize the imperative for transparency and accountability within crypto exchanges and service providers. Lastly, these case studies serve as potent reminders of the ever-evolving tactics employed by cybercriminals, necessitating constant vigilance and adaptation in defense strategies.

Attack Vectors: How Cybercriminals Target Crypto Investors

Moreover, understanding the attack vectors employed by cybercriminals provides insights into safeguarding your investments. From sophisticated phishing schemes that exploit human trust to vulnerabilities in smart contracts and flash loan exploits, the avenues for exploitation are diverse and evolving. Furthermore, the compromise of private keys remains a predominant threat, highlighting the need for secure storage practices and heightened awareness among crypto users. Lastly, the landscape of Crypto Cybercrime 2024 underscores the importance of education and proactive measures in mitigating risks in the digital asset space.https://w3ultra.com/bitcoin-market-volatility-july-2024/

Trends and Statistics in Crypto Cybercrime 2024

As investors navigate this challenging terrain, understanding these trends and statistics is crucial in formulating robust risk management strategies and fortifying defenses against emerging cyber threats.

Statistical Overview: Numbers Behind the Surge

Crypto Cybercrime 2024 isn’t just about headlines—it’s about the stark numerical realities facing investors and stakeholders. The $1.38 billion stolen in the first half of the year alone represents a significant escalation from previous years, painting a concerning picture of escalating threats in the digital finance arena. Moreover, the frequency and scale of these attacks highlight the urgent need for comprehensive security frameworks and regulatory measures to safeguard against future incidents.

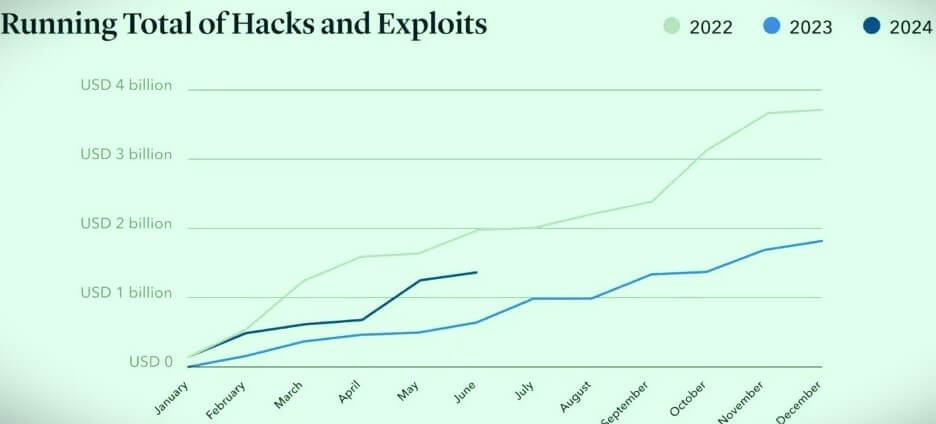

Comparative Analysis: Crypto cybercrime 2024vs. Previous Years

Comparing Crypto Cybercrime 2024 with past years reveals alarming trends and shifts in tactics employed by cybercriminals. Besides the doubling of financial losses compared to 2023, the sheer audacity and scale of recent attacks underscore a growing sophistication among threat actors. Furthermore, the continuous evolution of attack vectors demands adaptive responses from both industry stakeholders and regulatory bodies alike. Lastly, these comparisons serve as critical benchmarks for assessing the effectiveness of current cybersecurity measures and shaping future strategies.

Vulnerabilities Explored: Private Keys, Phishing, and More

Moreover, delving into the vulnerabilities exploited in Crypto Cybercrime 2024 sheds light on critical areas for improvement and vigilance. The compromise of private keys, for instance, remains a primary avenue for theft, highlighting the importance of secure storage practices and decentralized custody solutions. Additionally, the rise of phishing scams targeting crypto users underscores the need for heightened awareness and education. Lastly, vulnerabilities in smart contracts and decentralized finance (DeFi) protocols pose unique challenges, requiring innovative approaches to mitigate risks effectively.

Protecting Your Investments: Strategies Against Crypto cybercrime 2024

In the realm of digital assets, safeguarding your investments against the escalating threats of Crypto Cybercrime 2024 requires proactive measures and a keen understanding of potential vulnerabilities. Securing your private keys, the gateway to your digital holdings, stands as the cornerstone of effective protection.https://swissmoney.com/cryptocurrency-security/

Securing Your Private Keys for Crypto cybercrime 2024

Protecting your investments in the face of Crypto Cybercrime 2024 begins with safeguarding your private keys—a fundamental aspect of digital asset security. Implementing robust encryption and storage solutions can significantly mitigate the risk of unauthorized access and theft. Moreover, adopting hardware wallets and multi-signature authentication adds layers of protection against potential vulnerabilities in software-based solutions. Lastly, maintaining strict confidentiality regarding your private keys is essential to thwarting malicious attempts at unauthorized access.

Recognizing and Avoiding Phishing Scams

Besides securing your private keys, recognizing and avoiding phishing scams is crucial in defending against cyber threats. Cybercriminals often employ deceptive tactics to lure unsuspecting victims into disclosing sensitive information or transferring funds to fraudulent accounts. Moreover, scrutinizing URLs, verifying the authenticity of communications, and avoiding suspicious links and attachments are essential practices in safeguarding your digital assets. Lastly, educating yourself and your peers about common phishing tactics can fortify your defenses against evolving cyber threats.

The Role of Regulations and Institutional Safeguards

Moreover, navigating the landscape of Crypto Cybercrime 2024 necessitates robust regulatory frameworks and institutional safeguards. Regulatory bodies play a pivotal role in enforcing compliance standards, promoting transparency, and holding accountable entities accountable for lapses in cybersecurity measures. Furthermore, collaborations between industry stakeholders and regulatory authorities are crucial in fostering a resilient ecosystem that prioritizes investor protection and market integrity. Lastly, advocating for proactive regulatory measures can help mitigate systemic risks and bolster investor confidence in the digital asset space.

Responding to a Cyber Attack: What to Do If You’re Targeted

Responding swiftly to a cyber attack is crucial to mitigate potential damage and safeguard your digital assets. If you suspect unauthorized access or suspicious activity involving your crypto holdings, immediate action is paramount.

Crypto cybercrime 2024: securing Your Assets

Responding swiftly to a cyber attack is paramount in minimizing potential losses and mitigating further risks. If you suspect unauthorized access or suspicious activity involving your crypto assets, immediately disconnect affected devices from the internet to prevent further compromise. Furthermore, reporting the incident to your crypto exchange or wallet provider enables them to initiate security protocols and investigate the breach. Lastly, documenting all communications and actions taken can facilitate recovery efforts and assist authorities in pursuing legal recourse against perpetrators.

Reporting and Recovery: Dealing with Exchanges and Authorities

Besides securing your assets, reporting the cyber attack to relevant authorities and exchanges is essential in facilitating recovery and preventing similar incidents. Timely communication with law enforcement agencies and regulatory bodies can aid in tracing stolen funds and identifying responsible parties. Moreover, collaborating with crypto exchanges and service providers to freeze affected accounts and implement enhanced security measures is crucial in restoring confidence and mitigating potential future risks. Lastly, maintaining open lines of communication throughout the recovery process ensures transparency and accountability in resolving the incident.

Case Studies: Successful Recovery Stories and Lessons

Lastly, examining successful recovery stories from past cyber attacks provides invaluable insights and strategies for resilience. Besides highlighting effective response protocols and collaboration between stakeholders, these case studies underscore the importance of proactive risk management and preparedness. Moreover, sharing lessons learned from successful recovery efforts can empower individuals and organizations to strengthen their defenses against future threats. Lastly, fostering a culture of transparency and resilience within the crypto community is essential in safeguarding investments and maintaining trust in digital finance.

Staying Ahead: Navigating the Evolving Landscape of Crypto Security

As we conclude our exploration of Crypto Cybercrime 2024, one thing is abundantly clear: staying ahead in the digital finance arena requires continuous adaptation and vigilance. Besides implementing robust security measures and adhering to best practices, proactive engagement with regulatory developments and industry standards is crucial in safeguarding investments. Moreover, fostering a culture of cybersecurity awareness and resilience within the crypto community can mitigate risks and fortify defenses against evolving cyber threats. Lastly, by remaining informed and proactive, investors can navigate the complexities of Crypto Cybercrime 2024 with confidence and safeguard their digital assets effectively.